Jiuzhou Pharmaceutical ESG Rating Update—LSEG ESG Score Continues to Rise, Wind ESG Rating Upgraded to AA

Release time:

2025-07-08

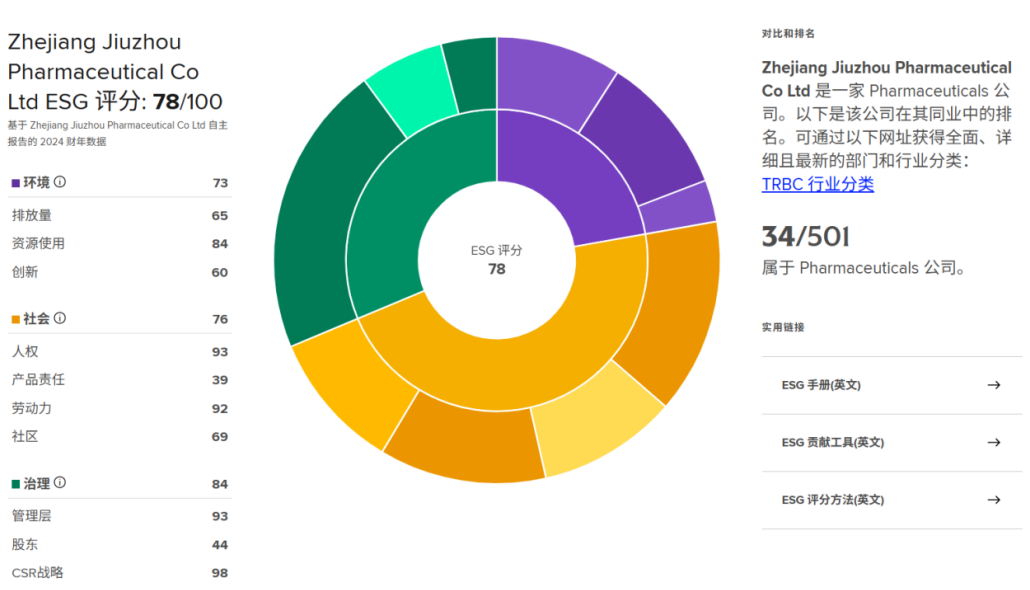

Recently, Jiuzhou Pharma has once again excelled in ESG rating performance: The London Stock Exchange Group (LSEG) updated its ESG score for Jiuzhou Pharma based on the company’s fiscal year 2024 data, increasing it from 74 to 78 points. Meanwhile, China’s financial information service provider Wind released its 2024 Environmental, Social, and Governance (ESG) rating results, awarding Jiuzhou Pharma an AA rating.

The LSEG ESG score was improved to 78 points

According to the LSEG official website, the LSEG ESG score aims to transparently and objectively measure a company’s relative ESG performance, commitment, and effectiveness across 10 major themes—such as emissions, environmental product innovation, human rights, and shareholders—based on publicly reported data. This score is calculated using a percentile ranking method across these ten categories.

| Score range | Description | |

| 0 to 25 | First Quartile | Scores within this range indicates poor relative ESG performance and insufficient degree of transparency in reporting material ESG data publicly. |

| > 25 to 50 | Second Quartile | Scores within this range indicates satisfactory relative ESG performance and moderate degree of transparency in reporting material ESG data publicly. |

| > 50 to 75 | Third Quartile | Scores within this range indicates good relative ESG performance and above average degree of transparency in reporting material ESG data publicly. |

| > 75 to 100 | Fourth Quartile | Score within this range indicates excellent relative ESG performance and high degree of transparency in reporting material ESG data publicly. |

This time, Jiuzhou Pharma’s LSEG ESG score increased from 74 to 78, moving from the third percentile to the fourth percentile. This demonstrates Jiuzhou Pharma’s outstanding relative ESG performance and a high level of transparency in publicly reporting significant ESG data.

Wind ESG Rating Jumps to AA Grade

According to the Wind ESG Rating Methodology, companies awarded an AA rating are defined as having “high corporate management standards, low ESG risk, and strong sustainability capabilities.” Public data shows that as of July 6, 2025, only 6.40% of A-share listed companies in China have achieved an AA rating or above, and within the pharmaceutical industry, only 3.55% have ratings of AA or higher. Jiuzhou Pharma’s AA rating is undoubtedly a full recognition of its outstanding management ability and comprehensive strength in ESG and sustainable development.

Multiple recognitions confirm the effectiveness of Jiuzhou Pharmaceutical's ESG strategy

Every step forward in Jiuzhou Pharma’s ESG practices benefits from the joint support of shareholders, partners, employees, and all sectors of society. It is this trust and consensus that drives us to continuously improve our ESG management level. Looking ahead, we will promote green and low-carbon transformation with higher standards, respond to industry changes with stronger resilience, and collaborate openly with global partners for mutual progress.

About the LSEG ESG score

LSEG is one of the world’s leading providers of financial markets infrastructure and delivers financial data, analytics, news and index products to 44,000+ customers in over 170 countries.

ESG scores from LSEG are designed to transparently and objectively measure a company's relative ESG performance, commitment and effectiveness across 10 main themes (emissions, environmental product innovation, human rights, shareholders, etc.) based on publicly-reported data.

The LSEG ESG score reflects a relevant ESG data framework and measures a company's ESG performance based on publicly verifiable reported data. It captures and calculates over 870 company-level ESG measures, of which a subset of 186 of the most comparable and material per industry power the overall company assessment and scoring process. These are grouped into 10 categories that form the three pillar scores and the final ESG score, which is a reflection of the company’s ESG performance, commitment and effectiveness based on publicly reported information.

About the Wind ESG rating

The Wind ESG Rating is a leading and highly influential ESG evaluation framework in China. It takes a forward-looking approach to assess companies’ material ESG risks and their ability to operate sustainably, evaluating both their ESG commitments and performance. This helps investors identify key risks and opportunities in their investment decisions. The Wind ESG rating currently covers all A-share and Hong Kong-listed companies, as well as major bond issuers—more than 12,000 entities in total.

The Wind ESG evaluation system consists of two key components: an assessment of ESG management practices and an evaluation of controversy events. This dual approach provides a comprehensive picture of a company's ESG management level and its exposure to significant and unexpected risks. The Wind ESG rating framework draws on internationally recognized ESG standards, while incorporating the specific context of China’s capital markets, regulatory landscape, and corporate ESG practices. It has developed a localized, science-based indicator system that is well-suited for assessing Chinese companies.The ESG evaluation spans three primary dimensions, 29 topics, and over 2,000 data points.

Other News

Therapeutic Peptides: An Emerging Therapeutic Force in Modern Medicine

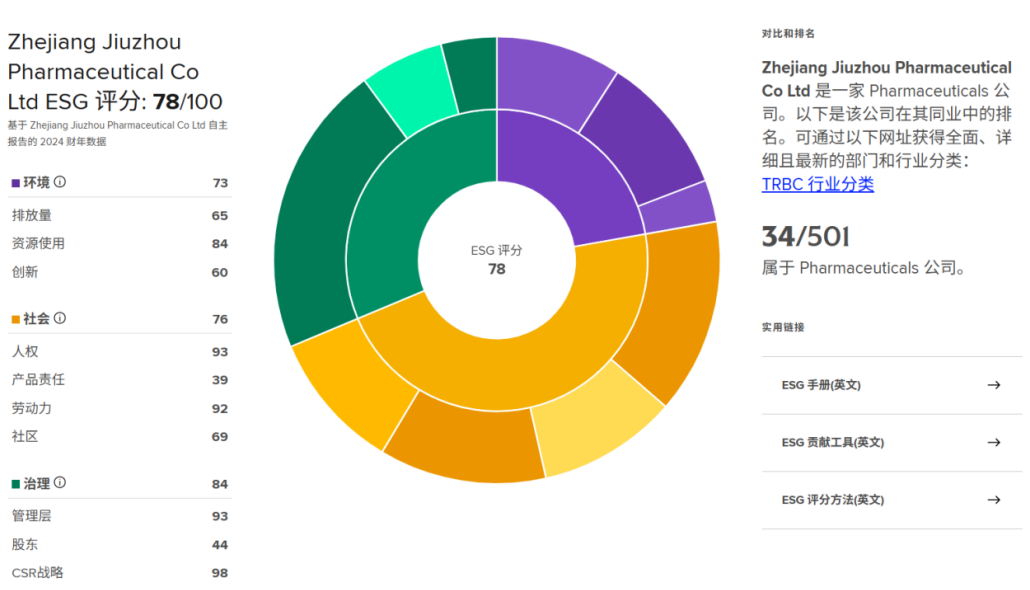

Recently, Jiuzhou Pharma has once again excelled in ESG rating performance: The London Stock Exchange Group (LSEG) updated its ESG score for Jiuzhou Pharma based on the company’s fiscal year 2024 data, increasing it from 74 to 78 points. Meanwhile, China’s financial information service provider Wind released its 2024 Environmental, Social, and Governance (ESG) rating results, awarding Jiuzhou Pharma an AA rating.

The LSEG ESG score was improved to 78 points

According to the LSEG official website, the LSEG ESG score aims to transparently and objectively measure a company’s relative ESG performance, commitment, and effectiveness across 10 major themes—such as emissions, environmental product innovation, human rights, and shareholders—based on publicly reported data. This score is calculated using a percentile ranking method across these ten categories.

| Score range | Description | |

| 0 to 25 | First Quartile | Scores within this range indicates poor relative ESG performance and insufficient degree of transparency in reporting material ESG data publicly. |

| > 25 to 50 | Second Quartile | Scores within this range indicates satisfactory relative ESG performance and moderate degree of transparency in reporting material ESG data publicly. |

| > 50 to 75 | Third Quartile | Scores within this range indicates good relative ESG performance and above average degree of transparency in reporting material ESG data publicly. |

| > 75 to 100 | Fourth Quartile | Score within this range indicates excellent relative ESG performance and high degree of transparency in reporting material ESG data publicly. |

This time, Jiuzhou Pharma’s LSEG ESG score increased from 74 to 78, moving from the third percentile to the fourth percentile. This demonstrates Jiuzhou Pharma’s outstanding relative ESG performance and a high level of transparency in publicly reporting significant ESG data.

Wind ESG Rating Jumps to AA Grade

According to the Wind ESG Rating Methodology, companies awarded an AA rating are defined as having “high corporate management standards, low ESG risk, and strong sustainability capabilities.” Public data shows that as of July 6, 2025, only 6.40% of A-share listed companies in China have achieved an AA rating or above, and within the pharmaceutical industry, only 3.55% have ratings of AA or higher. Jiuzhou Pharma’s AA rating is undoubtedly a full recognition of its outstanding management ability and comprehensive strength in ESG and sustainable development.

Multiple recognitions confirm the effectiveness of Jiuzhou Pharmaceutical's ESG strategy

Every step forward in Jiuzhou Pharma’s ESG practices benefits from the joint support of shareholders, partners, employees, and all sectors of society. It is this trust and consensus that drives us to continuously improve our ESG management level. Looking ahead, we will promote green and low-carbon transformation with higher standards, respond to industry changes with stronger resilience, and collaborate openly with global partners for mutual progress.

About the LSEG ESG score

LSEG is one of the world’s leading providers of financial markets infrastructure and delivers financial data, analytics, news and index products to 44,000+ customers in over 170 countries.

ESG scores from LSEG are designed to transparently and objectively measure a company's relative ESG performance, commitment and effectiveness across 10 main themes (emissions, environmental product innovation, human rights, shareholders, etc.) based on publicly-reported data.

The LSEG ESG score reflects a relevant ESG data framework and measures a company's ESG performance based on publicly verifiable reported data. It captures and calculates over 870 company-level ESG measures, of which a subset of 186 of the most comparable and material per industry power the overall company assessment and scoring process. These are grouped into 10 categories that form the three pillar scores and the final ESG score, which is a reflection of the company’s ESG performance, commitment and effectiveness based on publicly reported information.

About the Wind ESG rating

The Wind ESG Rating is a leading and highly influential ESG evaluation framework in China. It takes a forward-looking approach to assess companies’ material ESG risks and their ability to operate sustainably, evaluating both their ESG commitments and performance. This helps investors identify key risks and opportunities in their investment decisions. The Wind ESG rating currently covers all A-share and Hong Kong-listed companies, as well as major bond issuers—more than 12,000 entities in total.

The Wind ESG evaluation system consists of two key components: an assessment of ESG management practices and an evaluation of controversy events. This dual approach provides a comprehensive picture of a company's ESG management level and its exposure to significant and unexpected risks. The Wind ESG rating framework draws on internationally recognized ESG standards, while incorporating the specific context of China’s capital markets, regulatory landscape, and corporate ESG practices. It has developed a localized, science-based indicator system that is well-suited for assessing Chinese companies.The ESG evaluation spans three primary dimensions, 29 topics, and over 2,000 data points.

2026-02-12

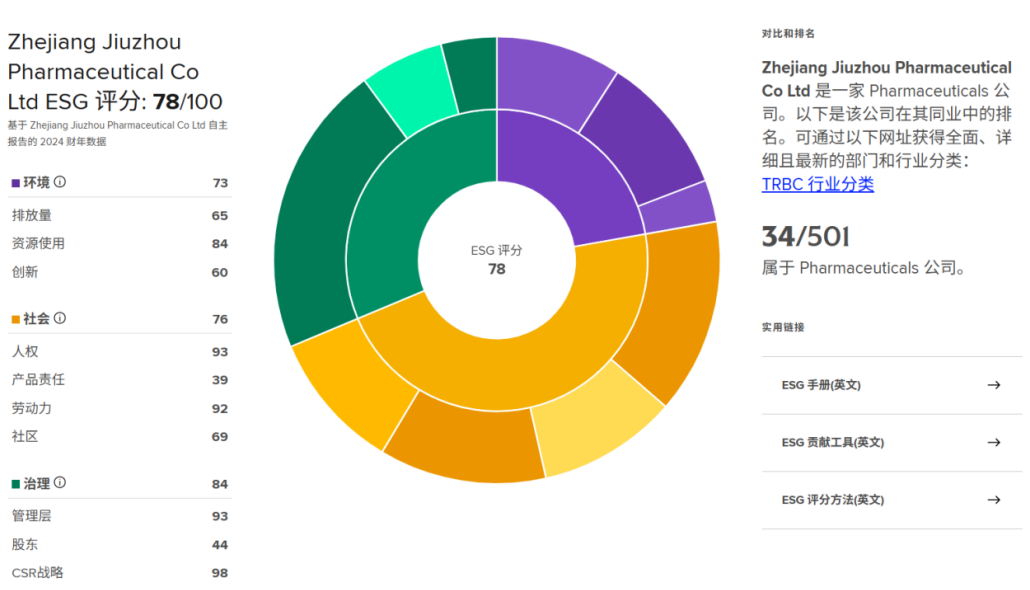

Recently, Jiuzhou Pharma has once again excelled in ESG rating performance: The London Stock Exchange Group (LSEG) updated its ESG score for Jiuzhou Pharma based on the company’s fiscal year 2024 data, increasing it from 74 to 78 points. Meanwhile, China’s financial information service provider Wind released its 2024 Environmental, Social, and Governance (ESG) rating results, awarding Jiuzhou Pharma an AA rating.

The LSEG ESG score was improved to 78 points

According to the LSEG official website, the LSEG ESG score aims to transparently and objectively measure a company’s relative ESG performance, commitment, and effectiveness across 10 major themes—such as emissions, environmental product innovation, human rights, and shareholders—based on publicly reported data. This score is calculated using a percentile ranking method across these ten categories.

| Score range | Description | |

| 0 to 25 | First Quartile | Scores within this range indicates poor relative ESG performance and insufficient degree of transparency in reporting material ESG data publicly. |

| > 25 to 50 | Second Quartile | Scores within this range indicates satisfactory relative ESG performance and moderate degree of transparency in reporting material ESG data publicly. |

| > 50 to 75 | Third Quartile | Scores within this range indicates good relative ESG performance and above average degree of transparency in reporting material ESG data publicly. |

| > 75 to 100 | Fourth Quartile | Score within this range indicates excellent relative ESG performance and high degree of transparency in reporting material ESG data publicly. |

This time, Jiuzhou Pharma’s LSEG ESG score increased from 74 to 78, moving from the third percentile to the fourth percentile. This demonstrates Jiuzhou Pharma’s outstanding relative ESG performance and a high level of transparency in publicly reporting significant ESG data.

Wind ESG Rating Jumps to AA Grade

According to the Wind ESG Rating Methodology, companies awarded an AA rating are defined as having “high corporate management standards, low ESG risk, and strong sustainability capabilities.” Public data shows that as of July 6, 2025, only 6.40% of A-share listed companies in China have achieved an AA rating or above, and within the pharmaceutical industry, only 3.55% have ratings of AA or higher. Jiuzhou Pharma’s AA rating is undoubtedly a full recognition of its outstanding management ability and comprehensive strength in ESG and sustainable development.

Multiple recognitions confirm the effectiveness of Jiuzhou Pharmaceutical's ESG strategy

Every step forward in Jiuzhou Pharma’s ESG practices benefits from the joint support of shareholders, partners, employees, and all sectors of society. It is this trust and consensus that drives us to continuously improve our ESG management level. Looking ahead, we will promote green and low-carbon transformation with higher standards, respond to industry changes with stronger resilience, and collaborate openly with global partners for mutual progress.

About the LSEG ESG score

LSEG is one of the world’s leading providers of financial markets infrastructure and delivers financial data, analytics, news and index products to 44,000+ customers in over 170 countries.

ESG scores from LSEG are designed to transparently and objectively measure a company's relative ESG performance, commitment and effectiveness across 10 main themes (emissions, environmental product innovation, human rights, shareholders, etc.) based on publicly-reported data.

The LSEG ESG score reflects a relevant ESG data framework and measures a company's ESG performance based on publicly verifiable reported data. It captures and calculates over 870 company-level ESG measures, of which a subset of 186 of the most comparable and material per industry power the overall company assessment and scoring process. These are grouped into 10 categories that form the three pillar scores and the final ESG score, which is a reflection of the company’s ESG performance, commitment and effectiveness based on publicly reported information.

About the Wind ESG rating

The Wind ESG Rating is a leading and highly influential ESG evaluation framework in China. It takes a forward-looking approach to assess companies’ material ESG risks and their ability to operate sustainably, evaluating both their ESG commitments and performance. This helps investors identify key risks and opportunities in their investment decisions. The Wind ESG rating currently covers all A-share and Hong Kong-listed companies, as well as major bond issuers—more than 12,000 entities in total.

The Wind ESG evaluation system consists of two key components: an assessment of ESG management practices and an evaluation of controversy events. This dual approach provides a comprehensive picture of a company's ESG management level and its exposure to significant and unexpected risks. The Wind ESG rating framework draws on internationally recognized ESG standards, while incorporating the specific context of China’s capital markets, regulatory landscape, and corporate ESG practices. It has developed a localized, science-based indicator system that is well-suited for assessing Chinese companies.The ESG evaluation spans three primary dimensions, 29 topics, and over 2,000 data points.

2026-02-11

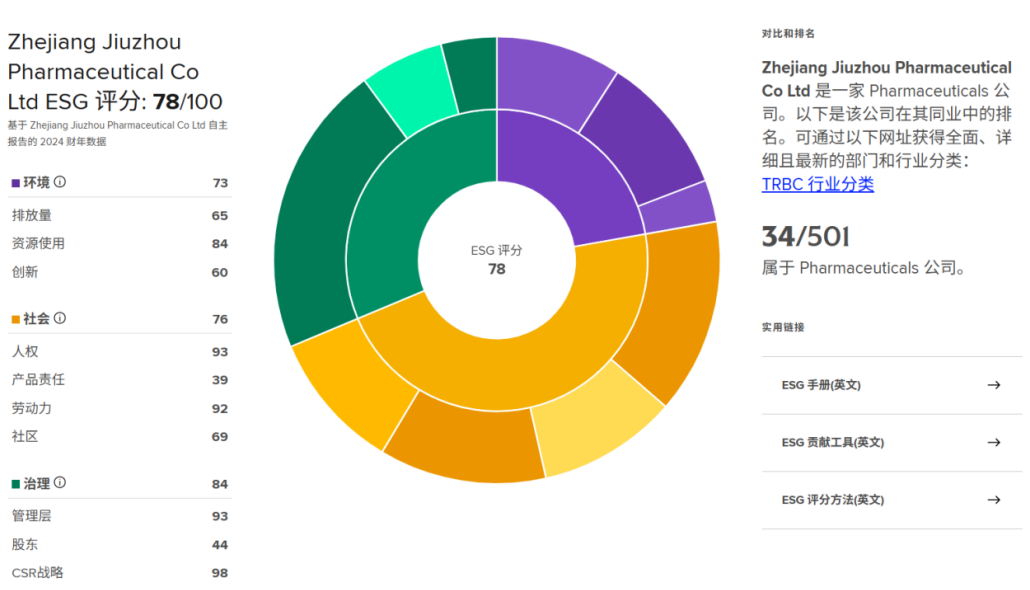

Recently, Jiuzhou Pharma has once again excelled in ESG rating performance: The London Stock Exchange Group (LSEG) updated its ESG score for Jiuzhou Pharma based on the company’s fiscal year 2024 data, increasing it from 74 to 78 points. Meanwhile, China’s financial information service provider Wind released its 2024 Environmental, Social, and Governance (ESG) rating results, awarding Jiuzhou Pharma an AA rating.

The LSEG ESG score was improved to 78 points

According to the LSEG official website, the LSEG ESG score aims to transparently and objectively measure a company’s relative ESG performance, commitment, and effectiveness across 10 major themes—such as emissions, environmental product innovation, human rights, and shareholders—based on publicly reported data. This score is calculated using a percentile ranking method across these ten categories.

| Score range | Description | |

| 0 to 25 | First Quartile | Scores within this range indicates poor relative ESG performance and insufficient degree of transparency in reporting material ESG data publicly. |

| > 25 to 50 | Second Quartile | Scores within this range indicates satisfactory relative ESG performance and moderate degree of transparency in reporting material ESG data publicly. |

| > 50 to 75 | Third Quartile | Scores within this range indicates good relative ESG performance and above average degree of transparency in reporting material ESG data publicly. |

| > 75 to 100 | Fourth Quartile | Score within this range indicates excellent relative ESG performance and high degree of transparency in reporting material ESG data publicly. |

This time, Jiuzhou Pharma’s LSEG ESG score increased from 74 to 78, moving from the third percentile to the fourth percentile. This demonstrates Jiuzhou Pharma’s outstanding relative ESG performance and a high level of transparency in publicly reporting significant ESG data.

Wind ESG Rating Jumps to AA Grade

According to the Wind ESG Rating Methodology, companies awarded an AA rating are defined as having “high corporate management standards, low ESG risk, and strong sustainability capabilities.” Public data shows that as of July 6, 2025, only 6.40% of A-share listed companies in China have achieved an AA rating or above, and within the pharmaceutical industry, only 3.55% have ratings of AA or higher. Jiuzhou Pharma’s AA rating is undoubtedly a full recognition of its outstanding management ability and comprehensive strength in ESG and sustainable development.

Multiple recognitions confirm the effectiveness of Jiuzhou Pharmaceutical's ESG strategy

Every step forward in Jiuzhou Pharma’s ESG practices benefits from the joint support of shareholders, partners, employees, and all sectors of society. It is this trust and consensus that drives us to continuously improve our ESG management level. Looking ahead, we will promote green and low-carbon transformation with higher standards, respond to industry changes with stronger resilience, and collaborate openly with global partners for mutual progress.

About the LSEG ESG score

LSEG is one of the world’s leading providers of financial markets infrastructure and delivers financial data, analytics, news and index products to 44,000+ customers in over 170 countries.

ESG scores from LSEG are designed to transparently and objectively measure a company's relative ESG performance, commitment and effectiveness across 10 main themes (emissions, environmental product innovation, human rights, shareholders, etc.) based on publicly-reported data.

The LSEG ESG score reflects a relevant ESG data framework and measures a company's ESG performance based on publicly verifiable reported data. It captures and calculates over 870 company-level ESG measures, of which a subset of 186 of the most comparable and material per industry power the overall company assessment and scoring process. These are grouped into 10 categories that form the three pillar scores and the final ESG score, which is a reflection of the company’s ESG performance, commitment and effectiveness based on publicly reported information.

About the Wind ESG rating

The Wind ESG Rating is a leading and highly influential ESG evaluation framework in China. It takes a forward-looking approach to assess companies’ material ESG risks and their ability to operate sustainably, evaluating both their ESG commitments and performance. This helps investors identify key risks and opportunities in their investment decisions. The Wind ESG rating currently covers all A-share and Hong Kong-listed companies, as well as major bond issuers—more than 12,000 entities in total.

The Wind ESG evaluation system consists of two key components: an assessment of ESG management practices and an evaluation of controversy events. This dual approach provides a comprehensive picture of a company's ESG management level and its exposure to significant and unexpected risks. The Wind ESG rating framework draws on internationally recognized ESG standards, while incorporating the specific context of China’s capital markets, regulatory landscape, and corporate ESG practices. It has developed a localized, science-based indicator system that is well-suited for assessing Chinese companies.The ESG evaluation spans three primary dimensions, 29 topics, and over 2,000 data points.

2026-02-11